okies3D/iStock through Getty Photos

Introduction

Realty Revenue Company (NYSE:O) has garnered vital consideration within the industrial actual property sector, significantly because the trade grapples with a collection of financial challenges. On this article, I goal to supply an in-depth evaluation of the corporate’s efficiency in gentle of those financial woes. Particularly, we’ll discover the headwinds going through the sector, together with tighter lending situations, excessive rates of interest, and a excessive probability of Federal Reserve over-tightening. Regardless of these challenges, Realty Revenue’s strong enterprise mannequin and robust stability sheet have allowed it to take care of its spectacular efficiency.

Moreover, the surprisingly robust industrial retail fundamentals within the face of those dangers have additionally contributed to its success.

Moreover, I will assess the corporate’s dividend development potential, given its latest inclusion in a variety of mannequin portfolios (like this one). Primarily based on my evaluation of the macroeconomic panorama and the corporate’s particular strengths, I consider the inventory represents a lovely funding alternative, significantly throughout vital market corrections to enhance the danger/reward.

Let’s dive into the small print!

Mountaineering Till One thing Breaks

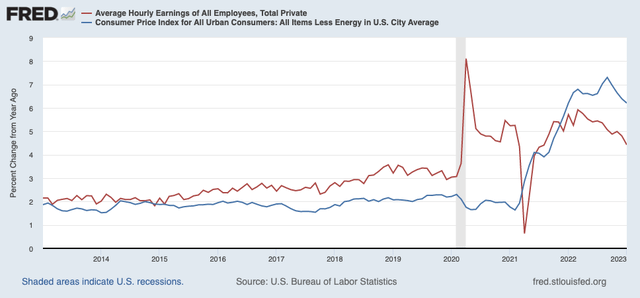

In most of my macro/market-focused articles, I point out that I count on the market to be caught in a risky sideways development between the low-3,000 and mid-4,000 factors vary. That is based mostly on my expectations that the Federal Reserve must do injury to the economic system to harm the underlying components that preserve inflation persistently excessive. Essentially the most distinguished issue is a wholesome labor market, which facilitates above-average wage development.

Federal Reserve Financial institution of St. Louis

Thus far, I’ve been confirmed proper, as markets bounced off the upper finish of my vary. The explanation was that market contributors began to cost in a extra aggressive Fed. Why is that, chances are you’ll ask? In any case, we’re past peak inflation.

The issue is that inflation is sticky. Very sticky. The Fed must put extra stress on the economic system to get inflation to its goal of two%. Getting inflation from 8% to six% is straightforward in comparison with getting it from 4% to 2%. Even trickier is preserving inflation at 2%. The Fed failed horribly within the Nineteen Seventies, which it doesn’t wish to repeat.

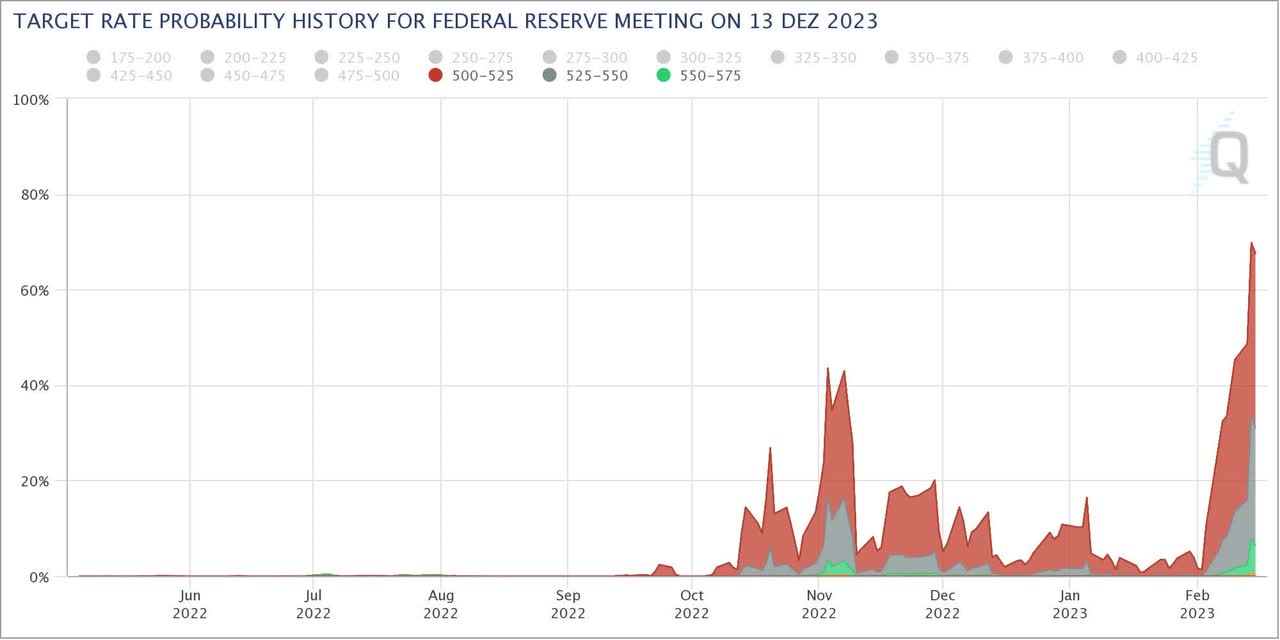

Now, the market implies that there is a 70% probability that we may finish this yr with a Fed funds price above 5.00%. Earlier this yr, that likelihood was 0%.

CME Group

As if all of this is not tough sufficient, we’re coping with financial growth-slowing. Whereas providers stay considerably robust, manufacturing sentiment has considerably weakened.

Federal Reserve Financial institution of Philadelphia

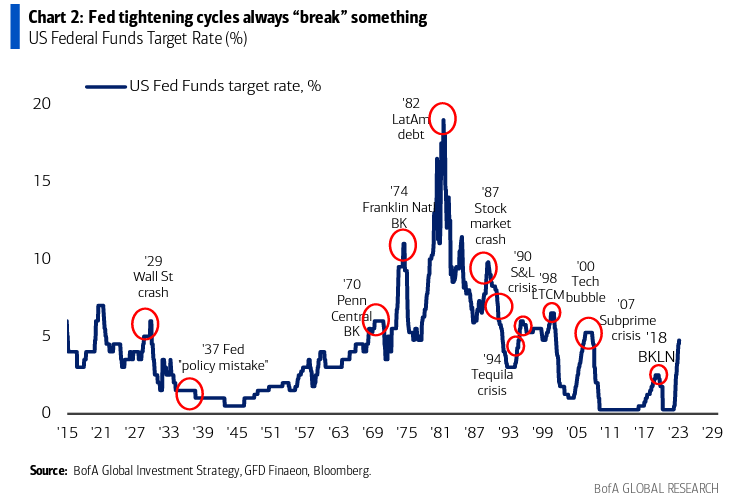

Therefore, we’re as soon as once more in a state of affairs the place the Fed is risking to interrupt one thing. By breaking one thing, I imply climbing an excessive amount of, which may set off a much bigger financial occasion that can finally drive the Fed to pivot.

Utilizing Financial institution of America knowledge, we see that the Fed has a observe report of breaking stuff.

Financial institution of America

For sure, the aforementioned components play an enormous function in (industrial) actual property.

Industrial Actual Property Is Weakening

Nonetheless, retail stays robust

Earlier than I began writing this text, Wells Fargo & Firm (WFC) got here out with a report mentioning that the likelihood of a delicate touchdown is growing on account of a strong labor market.

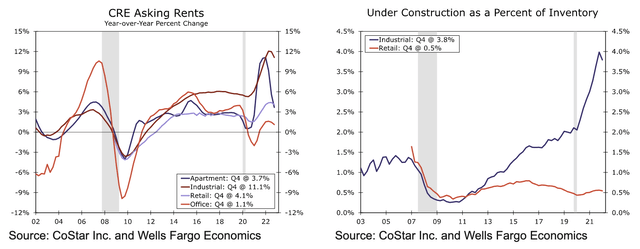

Nonetheless, the financial institution additionally famous that stress is beginning to weigh on CRE (industrial actual property) exercise. The excellent news is that weak spot, thus far, is restricted and primarily seen in two areas:

Workplace emptiness charges have been a problem for a really very long time. This downside began a long time in the past when places of work have been very tax-friendly investments. Additionally, no one was betting on the massive impression expertise may have on distant work. Emptiness charges are actually above 12%. In the meantime, condominium emptiness charges are normalizing after falling off a cliff after the pandemic.

Wells Fargo

The excellent news is that retail continues to be doing properly. Retail emptiness charges are dropping as demand is outpacing provide. The online absorption price elevated to 33.8 million sq. toes within the second half of 2022. Complete completions got here in at 15.2 million sq. toes.

Wells Fargo

Furthermore, the emptiness price of 4.2% in 4Q22 is the bottom on report (going again to 2007).

Rents improved by 4.1% in 4Q22, the second-best efficiency amongst main property sorts behind industrial.

Based on Wells Fargo:

The low ranges of latest retail building imply, even with a cooldown in rental demand from lowered client spending, retail emptiness charges are prone to stay low and help lease development within the retail area over the following few years.

Wells Fargo

Thus far, that is terrific information for retail, because it appears to resist mounting headwinds.

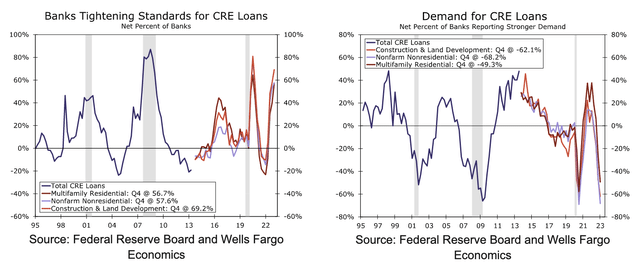

That stated, I am watching credit score. One of many explanation why new provide development is subdued is the truth that lending requirements have been tightened at a tempo just like the Nice Monetary Disaster and pandemic peaks.

Because of this, demand for brand spanking new CRE loans has imploded.

Wells Fargo

The excellent news is that these situations will forestall new provide development from accelerating. Nonetheless, I do see dangers within the poor well being of the buyer. I consider that CRE dangers for retail shouldn’t be underestimated – particularly not if the Fed hikes greater for longer.

With that stated, let’s look into Realty Revenue, the star of this text.

Realty Revenue Means Security & Dependable Revenue

On February 21, Realty Revenue reported its quarterly outcomes. The corporate reported FFO (funds from operations) of $1.00 in its 4Q22 quarter. This beat estimates by a penny. Normalized FFO elevated by 18.0% to $1.05. Complete income in that interval got here in at $888.7 million, an enchancment of 29.7% versus 4Q21. That quantity beat by $48.1 billion.

Realty Revenue

Furthermore, the corporate’s steering was robust. The corporate expects full-year FFO per share to be within the $4.01 to $4.13 vary. The common analyst estimate was $4.09. Identical-store lease is predicted to develop by over 1.25%. The occupancy goal is 98%.

The corporate ended the yr with an occupancy price of 99%, the very best occupancy price on the finish of a reporting interval in additional than 20 years!

That is a part of the soundness Realty Revenue brings to the desk. Based on Sumit Roy, President, and Chief Financial Officer:

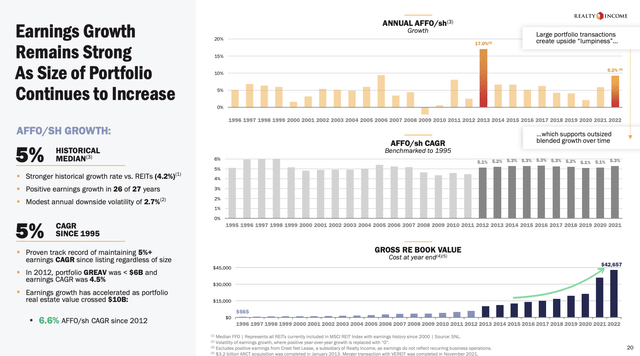

At Realty Revenue, we try to supply stability and sustainable development on behalf of our buyers. And during times of financial uncertainty like we discover ourselves in right this moment, the resilience demonstrated by our enterprise mannequin is essential to spotlight. Throughout our 28-year historical past as a public firm, our mixed complete return consisting of AFFO per share development and dividend funds generated by our operations has not skilled a single yr of draw back volatility within the type of damaging complete returns.

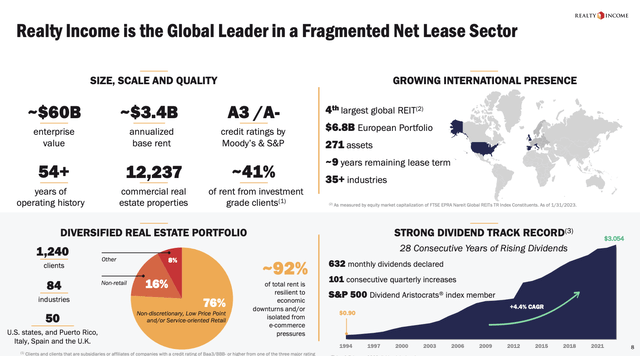

The corporate’s stability is among the core attributes buyers have centered on for greater than a decade. The corporate is among the few actual property funding trusts (“REITs”) with an A-rated stability sheet, has been in enterprise for greater than 54 years, owns greater than 12,000 industrial properties, and has 28 consecutive years of rising dividends, making the inventory a dividend aristocrat.

Realty Revenue

Since going public in 1994, the corporate has returned 14.6% per yr with a beta of 0.5 versus the S&P 500. In 26 of 27 years, the corporate has reported constructive earnings per share development.

The one problem the corporate is coping with is the (pending) chapter of Cineworld, which represents 1.4% of Realty Revenue’s portfolio. Realty Revenue has collected 100% of contractual lease from Cineworld properties since October 2022. Nonetheless, in an abundance of warning, the corporate recorded $13.7 million of extra reserves related to 9 Cineworld properties beforehand on accrual accounting within the fourth quarter.

Regardless of the chapter, Realty Revenue believes that its portfolio of Cineworld property typically outperformed the operator’s portfolio and can present an replace on the end result of negotiations when acceptable.

With that stated, the corporate is investing in development. The funding pipeline stays energetic, and so they plan to take a position over $5 billion in 2023.

Listed below are some areas the corporate is targeted on:

- The corporate is trying to penetrate the healthcare REIT market. This market advantages from 7.2% annual (anticipated) development in Medicare till at the very least 2030. This $2 trillion market additionally advantages from huge healthcare spending. Per-capita spending on healthcare is $13K per yr within the US. That is twice the OECD common.

- The corporate agreed to fund as much as $1 billion in growth alternatives in vertical farming. This can be achieved by an alliance with vertical farming firm Loads Limitless. Properties can be leased to Loads beneath long-term lease agreements.

- The corporate is increasing in Europe. For instance, the corporate now owns seven wholesale properties operated by the Metro Group for near $170 million. As a European, I’m conversant in Metro and consider the corporate is coping with a terrific long-term tenant that brings each development potential and stability.

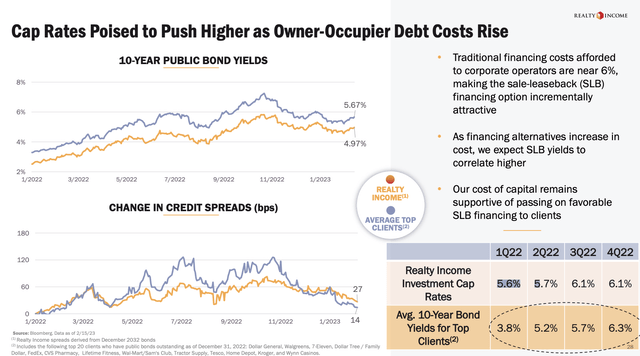

- The fourth level is intently tied to the previous ones and highlights the numerous benefit that Realty Revenue enjoys from its sale-leaseback (“SLB”) operations. Below this association, firms in want of funding promote the properties they personal, producing money, and subsequently lease them again from Realty Revenue. This not solely offers a gradual stream of earnings for the corporate but in addition reduces the tenant’s danger profile. The truth is, tenants are extra seemingly to enhance their enterprise with the proceeds from the true property sale, making them much less prone to default on their lease funds. Realty Revenue’s wholesome stability sheet offers it with the chance to supply enticing charges to potential SLB tenants, which makes it simpler to develop in that space. In any case, an organization with bad credit report wouldn’t have the ability to provide situations to a possible SLB buyer that beat discovering funding through banks or different methods.

Realty Revenue

With that stated, dividend development continued as properly.

The corporate just lately elevated its month-to-month dividend by 2.4%, representing a 3.2% development price over the earlier yr.

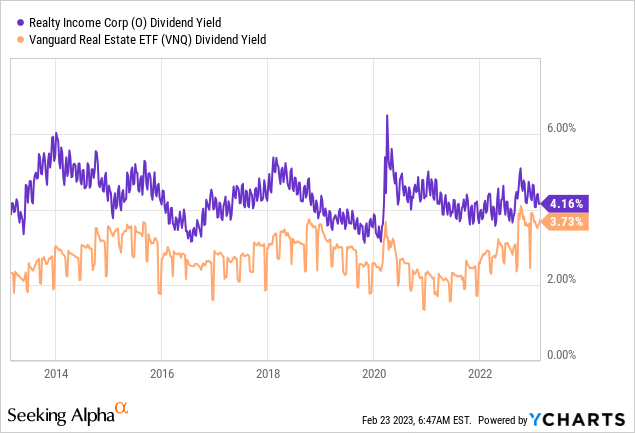

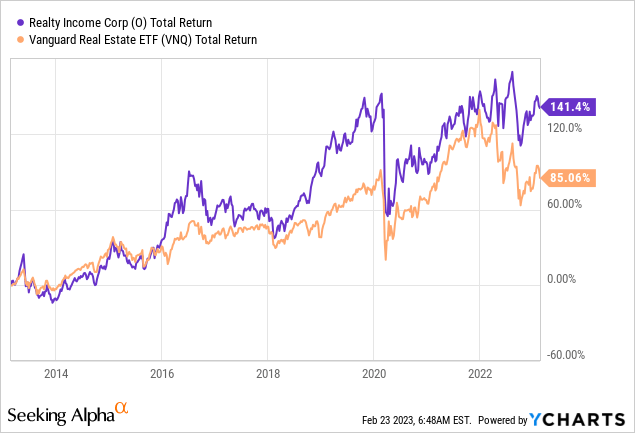

Realty Revenue at present pays a $0.2545 dividend per share per 30 days. This interprets to a yield of 4.7%, which may be very respectable. The corporate is persistently yielding greater than the Vanguard Actual Property ETF (VNQ). Please notice that the yield within the chart under has NOT been up to date. The yield premium is roughly 100 foundation factors.

Furthermore, the corporate has persistently outperformed this benchmark on a complete return foundation.

The corporate is actually the right mixture of:

- A unbelievable bullet-proof enterprise mannequin/portfolio.

- A wholesome stability sheet with loads of room to speed up development when others battle unfavorable financing situations.

- An above-average dividend yield with sluggish however regular dividend development.

- An honest outlook at a time when actual property markets are weakening.

- Lengthy-term outperformance, which I count on to final.

One Drawback, My Private Opinion & Timing

With that stated, there’s one problem. On account of its maturity, the corporate’s development charges are sluggish. As fellow contributor Jussi Askola wrote earlier this week:

Realty Revenue’s development has slowed down at the same time as inflation has shot up and consequently, it does not present enough safety in opposition to inflation anymore.

[…] Realty Revenue’s contractual lease hikes are materially smaller than these of its high-quality friends. Furthermore, its leases are additionally shorter, which will increase the danger of emptiness and the necessity for capex. It additionally does not have periodic CPI changes in its leases, not like WPC and VICI, and eventually, plainly it has extra leases with some capex duty than its friends. Most of its leases are “triple web” with no capex duty, nevertheless it additionally has some “double nets”, which usually put the duty of the roof/construction and/or the parking on the owner.

Particularly for income-focused buyers, shopping for a inventory that’s unlikely to beat (anticipated) inflation with its dividend hikes is considerably of a crimson flag.

The corporate’s money payout ratio is 66%. The sector median is 57%.

Nonetheless, my opinion is that Realty Revenue is a significantly better funding than lots of higher-yielding alternate options.

So, I consider there are two options.

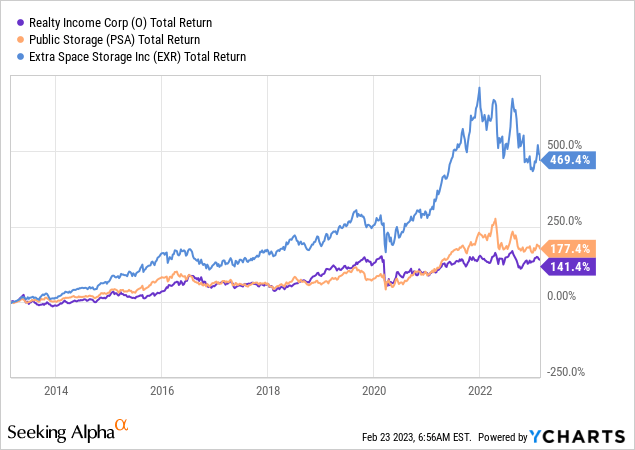

- Shopping for REITs with quicker development charges. For instance, I’m centered on self-storage actual property. I’ve massive positions in each Public Storage (PSA) and Further House Storage Inc. (EXR), which I’m going to increase within the months forward. These REITs are extra risky than O, but they’ve greater dividend development charges. Additionally they outperform O on a long-term foundation.

- Resolution quantity two is what I usually do once I like an organization however not the danger/reward it at present presents: ready for a greater entry. Realty Revenue is at present buying and selling at 15.7x 2023 FFO (I am utilizing the higher sure of its steering right here!). That’s truthful and in step with its net-lease peer group. It is a truthful valuation. Nonetheless, given my view on the Fed and the excessive probability that one thing breaks within the quarters forward, I consider that we would have the ability to purchase Realty Revenue at a greater valuation.

If Realty Revenue have been to supply a yield of greater than 5.2%, I consider it will be a very good funding, regardless of sluggish development charges.

Even higher, on weak spot, I consider that O is among the finest investments in actual property.

Takeaway

On this article, we have now explored one of many largest and most iconic actual property firms on the earth, Realty Revenue. Regardless of going through financial challenges comparable to greater rates of interest and poor client well being in 2022, the corporate has managed to increase its enterprise impressively. Moreover, Realty Revenue is exploring new avenues for development exterior of conventional retail actual property.

Furthermore, the retail actual property sector is performing properly, with demand development surpassing new provide, emptiness charges declining, and pricing alternatives remaining sturdy.

Nonetheless, Realty Revenue Company’s enterprise mannequin doesn’t provide excessive development potential. Revenue-oriented buyers might face challenges as inflation is predicted to outpace dividend development.

Contemplating this, there are two alternate options obtainable. One is investing in fast-growing REITs with respectable yields, which may result in greater volatility. Alternatively, I recommend an alternative choice based mostly on my view that the Fed is in a precarious place. Given the macroeconomic situations, it’s seemingly that the Fed will proceed to hike into financial weak spot, probably resulting in extreme financial penalties. Even Realty Revenue’s inventory, with its resilient enterprise mannequin and robust stability sheet, might be affected. If this occurs, I’d take into account shopping for the inventory throughout a dip, probably leading to an excellent higher yield.

In conclusion, regardless of the challenges, I stay optimistic about Realty Revenue’s future and take into account it to be among the finest REITs obtainable out there.